Recommendations for Corporate Governance in Denmark

The Board of Directors of A.P. Møller - Mærsk A/S continues to consider the "Recommendations for Corporate Governance" implemented by NASDAQ Copenhagen. Most of the recommendations have been complied with, but there are some which the Board of Directors has chosen not to follow. With reference to a "comply or explain" principle, NASDAQ Copenhagen has stated that companies should either comply with the recommendations or explain why they deviate from them.

Further information is available in the Statutory annual corporate governance statement, cf. Section 107b of the Danish Financial Statements Act covering the financial period 1 January to 31 December 2023

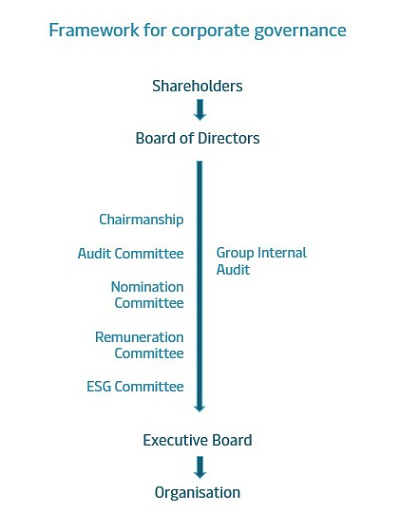

As a Danish company, A.P. Møller - Mærsk A/S has a two tier management structure consisting of the Board of Directors and the Management Board. Further information about the company's management structure is contained in the statement on corporate governance being part of the Annual report.