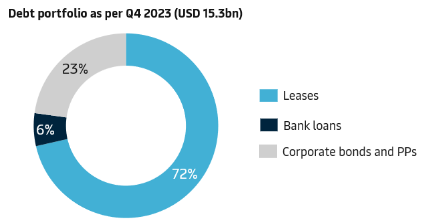

As a company with truly global operations, A.P. Møller-Mærsk A/S, uses a broad spectrum of financial instruments to raise funding such as corporate bonds, private placements, bank loans, leases, export credit financing etc.

Focus is on long-term funding with a balanced maturity profile with the aim to ensure ample liquidity available in order to secure financial flexibility.

A.P. Møller -Mærsk A/S continues to be the primary funding entity from which majority of the funding is raised from.

We are committed to remain investment grade rated and although there can be no assurances in this regard, we will take the required measures to defend our investment grade rating.